TO CONSIDER THE IMPOSITION OF AND TO PROVIDE FOR COLLECTION OF

NUISANCE ABATEMENT ASSESSMENTS

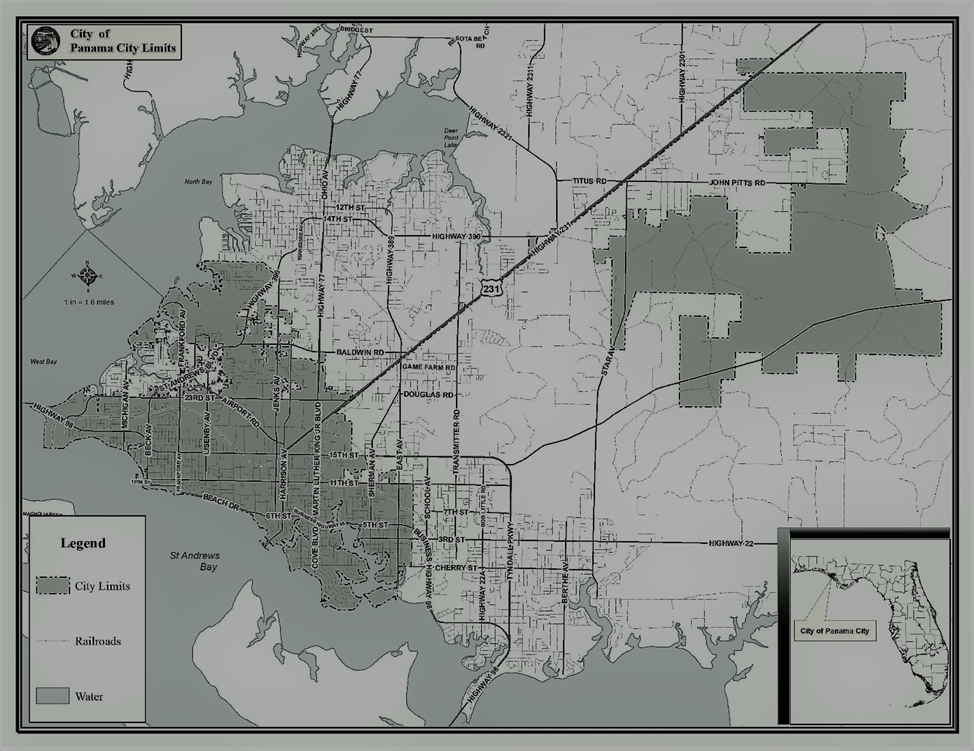

WITHIN THE ENTIRETY OF THE CITY OF PANAMA CITY, FLORIDA

The 49 properties proposed to be assessed lie within the City of Panama City, Florida.

Notice is hereby given that the City Commission of the City of Panama City, Florida, will conduct a public hearing to consider adoption of an annual Resolution related to the imposition of Nuisance Abatement Assessments for the provision of nuisance abatement services, facilities, and programs within the municipal boundaries of the City of Panama City to reimburse the City of costs expended to benefit these properties.

49 PROPERTIES ARE SCHEDULED TO BE ASSESSED. The list of properties scheduled to be assessed can be located online at www.panamacity.gov. The total nuisance abatement assessment revenue to be considered at the public hearing, including amounts to defray the City’s cost of assessment and the use of the uniform method of collection (including charges by the tax collector or property appraiser) and necessary adjustment for statutory discounts provided for by general law when collection occurs on the same tax notice or bill, is estimated to be $343,816.98. In July, the City will share the amounts of Nuisance Abatement Assessments as apportioned to each affected tax parcel in the City with the Bay County Property Appraiser under the additional and optional TRIM notice process pursuant to section 200.069, Florida Statutes. If not sooner paid, the assessments contemplated in this Notice will be imposed by the City Commission, not the local property appraiser or tax collector. Any activity of the County property appraiser or tax collector by law shall be construed solely as ministerial. Otherwise, payment is anticipated to be due and collected on the same bill as taxes to be mailed around November 1, 2023. This tax bill collection method is also sometimes called the uniform method of collection.

The assessment for each tax parcel will be based upon the actual costs incurred by the City attributable to the abatement of a nuisance on the tax parcel. The amount of the assessment has been determined as the result of an extraordinarily noticed Code Enforcement action where the City had to expend money to address or abate nuisances on the property and where such amount has been independently determined pursuant to a Special Magistrate’s Order. A more specific description of the nuisance abatement related services and improvements and the method of computing the assessment for each parcel of property is set forth in the City’s ordinance and this year’s proposed annual assessment resolution concerning Nuisance Abatement Assessments to be considered for adoption by the City Commission after a public hearing on July 11, 2023. Copies of the Nuisance Abatement Assessment Resolution and the preliminary Nuisance Abatement Assessment Roll are available for inspection at www.panamacity.gov or the office of the City Clerk, located at City Hall, 501 Harrison Avenue, Panama City, Florida.

Nuisance Abatement Assessments are special assessments, sometimes characterized as non-ad valorem assessments, which are collected on the same bill as for property taxes, against a property located within the boundaries of the City and collection of the assessments by the uniform collection billing method authorized by section 197.3632, Florida Statutes. Under general law, the City has presented and validated before the local Circuit Court, the means and approach to imposing Nuisance Abatement Assessments in conjunction with using the assessment proceeds as pledged revenues to finance future capital equipment or improvement expenditures. Failure to pay the assessments will cause a tax certificate to be issued against the property which may result in a loss of title.

A public hearing by the City Commission will be held at 8:00 A.M. on July 11, 2023, in the Bay County Commission Meeting Room located in the Bay County Government Complex, at 840 West 11th Street, Panama City, Florida 32401. All affected property owners have a right to appear at the hearing and to file written objections with the City Commission by email at [email protected] or written form sent to the City Clerk’s office at 501 Harrison Avenue, Panama City, Florida within twenty (20) days of this notice.

If you have questions, or desire to pay-off the amounts now due to the City, please contact the City Clerk’s Office at (850) 872-3021, and make sure you inform that you are inquiring about Nuisance Abatement Assessments.

ANY PERSON WISHING TO ENSURE THAT AN ADEQUATE RECORD OF THE PROCEEDINGS IS MAINTAINED FOR APPELLATE PURPOSES IS ADVISED TO MAKE THE NECESSARY ARRANGEMENTS FOR RECORDING AT HIS OR HER OWN EXPENSE.

PERSONS WITH DISABILITIES NEEDING ASSISTANCE TO PARTICIPATE IN ANY OF THESE PROCEEDINGS SHOULD CONTACT THE CITY CLERK AT LEAST 48 HOURS IN ADVANCE OF THE MEETING AT (850) 872-3021.

PUBLISHED AT THE DIRECTION OF THE CITY COMMISSION,

CITY OF PANAMA CITY, FLORIDA.

Publish on or before June 20, 2023.